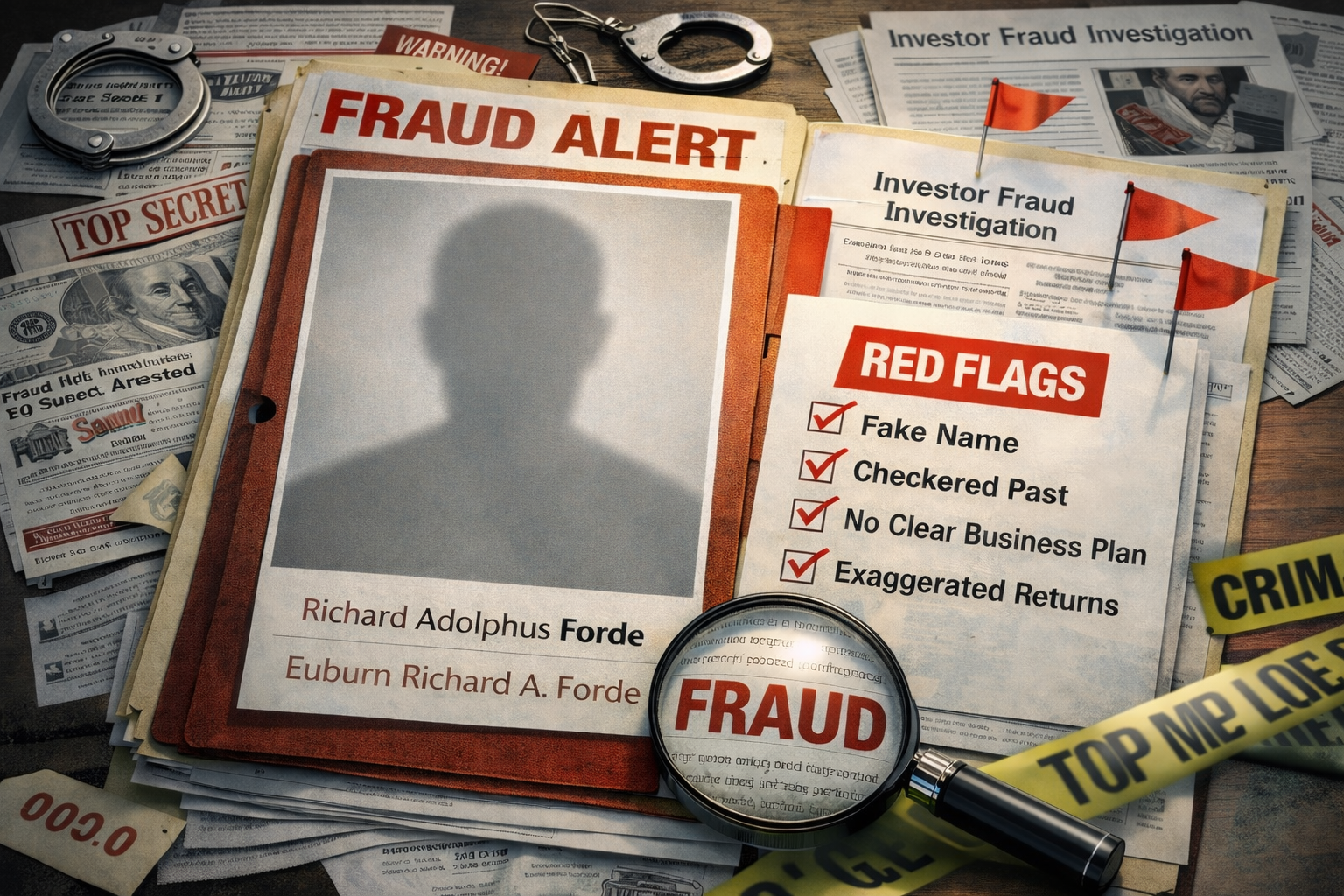

This article lays out a fact-based public record timeline tied to Richard Adolphus Forde (also known as Euburn Richard Forde) and then translates those facts into practical investor-fraud warning signs you can use when evaluating any private investment.

⸻

Why this matters

Investor fraud is rarely “one big lie.” It’s usually a pattern:

• bold claims used to calm investors or attract new ones

• missing or shifting details when challenged

• regulatory actions that show a history of misleading statements

• later financial or court trouble that reveals how the machine worked

The public record around Forde provides a clean example of how to spot that pattern early.

⸻

Timeline of publicly documented events

2000: SEC sued over allegedly false statements to investors

In August 2000, the SEC filed a civil enforcement complaint against Tutornet.com Group, Inc. and Euburn R.A. Forde, describing him as the company’s president/CEO/chairman. The SEC alleged false and misleading statements and omissions in a Form 8-K and a shareholder letter posted online—statements that, per the SEC, were used to reassure (“lull”) investors despite a precarious financial condition.

Key SEC-alleged themes (the fraud “shape” you should recognize):

• Big partnership implications (AOL) paired with missing disclosure that the relationship had been terminated.

• Large financing claim (a purported $30M investment) where the SEC alleged there was no reasonable basis and facts undermined the legitimacy of the claim.

• Government-adjacent credibility signaling (HUD rollout language) that the SEC alleged was false/misleading.

Sept–Oct 2000: Court injunctions; later an agreed permanent injunction and penalty

The SEC later announced a preliminary injunction order (September 2000).

In October 2000, the SEC reported an Agreed Order of Permanent Injunction (entered Oct. 23, 2000). The SEC also reported the order required amended filings and that Forde paid a $55,000 civil penalty (consented without admitting/denying).

Investor-fraud takeaway: when regulators allege “false and misleading statements” plus “omissions,” that’s not a marketing dispute—that’s the classic enforcement core of investor deception claims.

2002: Shareholders won a major judgment reported by a major outlet

In August 2002, The Washington Post reported a U.S. District Court awarded about $176 million to former Tutornet shareholders, describing the case as involving investor fraud findings and noting the company had been inundated with shareholder lawsuits; the article also notes Forde had settled an SEC lawsuit.

Investor-fraud takeaway: civil shareholder litigation (especially with large judgments) is often where detailed fact patterns surface—promises made, documents signed, and who controlled what.

2009: Federal conviction and prison sentence for fraud-related crimes

An FBI/USAO press release (archived) states that Richard A. Forde (also known as Euburn Richard Forde) was convicted in 2009 on charges including conspiracy, bankruptcy fraud, and bank fraud, tied to conduct described as a bankruptcy fraud scheme.

A separate FBI/USAO release states he was sentenced July 27, 2009 to 42 months in prison for his role in a mortgage fraud scheme spanning approximately Dec 2001–Jan 2004.

Investor-fraud takeaway: when someone has both (1) securities-law enforcement history and (2) later fraud convictions, that combination is a major risk marker for any investment where they are a control person, architect, promoter, or beneficiary.

⸻

The “fraud pattern” this record illustrates (what to look for in any deal)

1) “Credibility stacking” using big names

The SEC allegations described statements involving major brands/entities (e.g., AOL, HUD) to increase trust and reduce skepticism.

Red flag: name-dropping + implied scale + no independently verifiable contract terms.

2) Large-money claims without verifiable sources

The SEC alleged a claimed $30M investment lacked a reasonable basis and had weak diligence and unknown financial capacity.

Red flag: “funding is coming” / “commitment secured” with no bank proof, no closing conditions, no verified counterparty.

3) “Omission fraud”: leaving out the one fact that changes everything

The SEC alleged failing to disclose termination of a contract while continuing to describe it optimistically.

Red flag: updates that only include good news; bad news appears only if you dig.

4) Legal “clean-up” orders after the marketing push

The SEC reported orders requiring amended filings and injunctive relief.

Red flag: the story gets revised only after regulators step in.

5) Control-person risk

A repeated theme in fraud cases is that the control person shapes disclosures, messaging, and the flow of investor cash. The SEC described Forde as president/CEO/chairman in the action it filed.

Red flag: you’re told “the tech speaks for itself,” but one person controls the narrative, documents, and timelines.

⸻

How to use this as an investor-fraud screening checklist

If you’re assessing a private company today, treat these as required verification steps:

1. Search SEC litigation releases by the person’s name + known aliases

• Look for complaints, injunctions, penalties, or bars. (This is exactly where the Tutornet matter shows up.)

2. Search federal press releases for convictions/sentencing

• The FBI/USAO releases are often the cleanest non-paywalled summaries.

3. Search major outlets for shareholder judgments/lawsuits

• Large awards and findings can be reported even when the underlying docket is harder to read.

4. Map each promotional claim to a document that could survive discovery

• Contracts (signed, dated, counterparties verifiable)

• Bank confirmations / wire receipts (not screenshots)

• Patent numbers (USPTO/WIPO/EPO records)

• Customer LOIs that include real legal names and signatures

5. If the company refuses documentation, treat that as the answer

• Fraud rarely says “no”; it says “later,” “NDA,” “we can’t disclose,” or “trust the timeline.”

⸻

Bottom line

Public records associated with Richard Adolphus Forde / Euburn Richard Forde include:

• an SEC enforcement action alleging false/misleading statements and omissions to investors and resulting injunction/penalty

• a large shareholder judgment reported by a major newspaper

• federal conviction and a 42-month prison sentence tied to fraud crimes (per FBI/USAO releases)

Those are not “opinions”; they’re concrete verification points that—when present in any promoter/executive’s history—should trigger maximum skepticism and strict document-first diligence.